By Tom Williard, Vice President of NV5 Clean Energy

Clean energy projects, like solar, electric vehicle infrastructure, battery energy storage, microgrids, and energy efficiency upgrades require a significant amount of time, effort, and money.

There’s good news on the money front. The IRS released new guidelines on Inflation Reduction Act (IRA) investment tax credits (ITCs) available for both public and private organizations implementing clean energy and decarbonization projects.

If your project began operating after January 1, 2023, you may be eligible for a significant tax benefit from the IRS. But you must apply for credits in the tax year your system became operational. If your project was completed in 2023, you’ll need to act soon to apply for and claim your credits by your 2023 tax filing deadline.

Who is eligible?

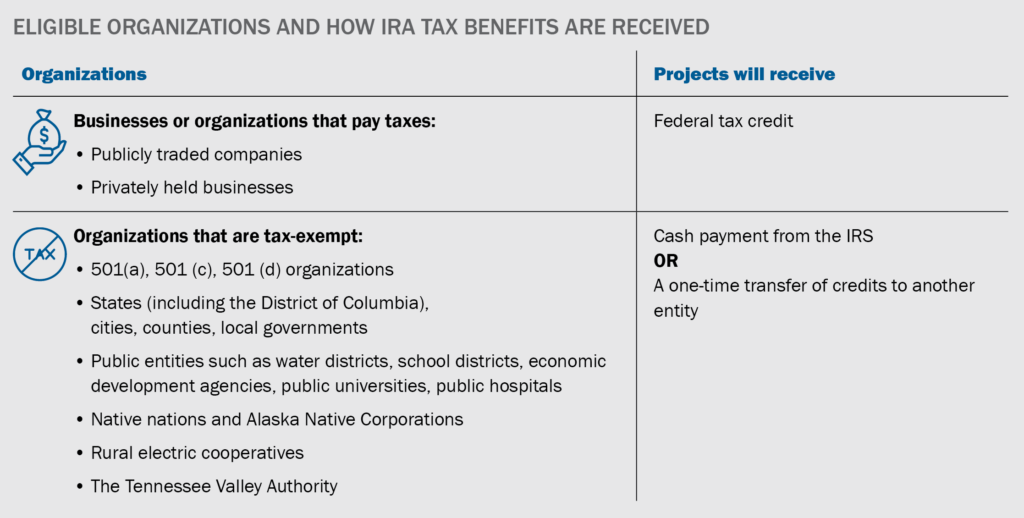

Almost any organization is eligible to receive benefits, assuming the project meets certain qualifications. How entities are compensated for their clean energy projects depends on the type of organization. Taxable entities receive a tax credit. Tax-exempt entities can either receive a cash payment through “Direct Pay” or a one-time “Transfer of Credits.” As an example, a public agency could receive 30 to 50 percent of the cost of its solar project back from the IRS.

What types of projects qualify?

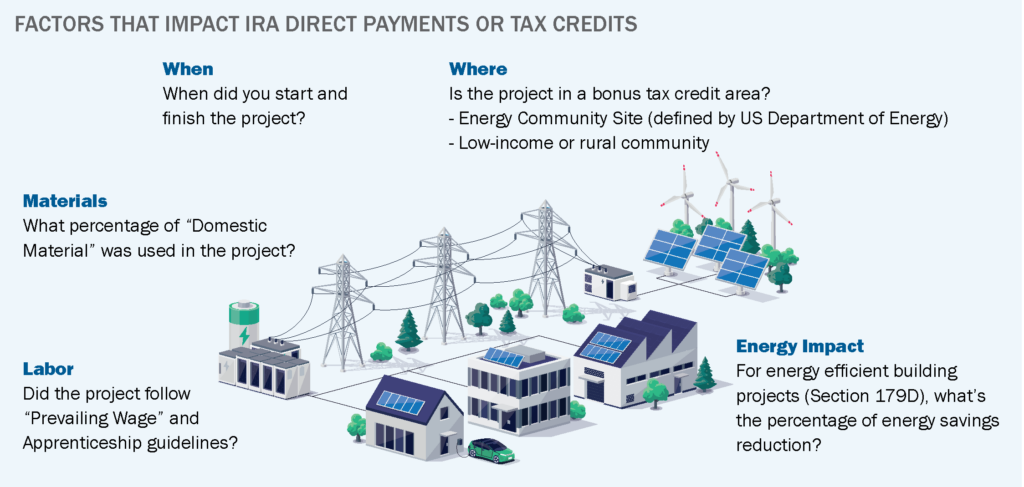

Clean energy projects such as solar, electric vehicle and charging stations, energy efficiency, battery energy storage, microgrid, and wind projects all can receive various amounts of credits, depending on several factors, including labor requirements, materials, and where projects are located. Importantly, electric vehicle infrastructure projects only qualify if the projects were built in low-income or rural areas.

Case Study: Public School District

Consider a school district that finished several clean energy projects in 2023. Because the district is in a low-income community that is also an “Energy Community Site,” it qualified for bonus tax credits.

How we can help:

About Tom Williard:

Tom Williard is vice president of the NV5 Clean Energy Group and specializes in building technical and financial models to predict potential energy asset production and financial performance. He has provided expert renewable energy consulting to public agencies and private companies for more than 20 years. Tom and his team can assist you and your legal/tax professionals in identifying IRA-eligible projects and structuring energy projects to maximize tax benefits.

NV5 is not a financial or legal advisor, or an accounting firm, and does not provide those services. Client will rely on appropriate financial, legal and accounting resources to confirm NV5 recommendations concerning the Inflation Reduction Act, Investment Tax Credits, Production Tax Credits, IRS 179D credits, and any other financial or legal information.